bricks and mortar or stocks and shares?

You’ve worked hard for your money, now you want to make it work for you. But where to put it?

Choosing between a property investment or buying stock could be like asking if the chicken or egg came first. But the former dilemma has a much more definitive answer. I say ‘more definitive’ as there are arguments for both, so let’s look at them.

property vs equity as an investment

One of the most obvious differences between these two investment vehicles is the level of barrier to entry. Anybody wishing to invest in stocks and shares can do so with just a few thousand pounds. Property can take several hundred times that amount. This financial aspect can block some participants from being able to invest in property at all.

Another consideration is the ease in which the investment can be made. In today’s modern world, stocks and shares can be purchased instantly using your mobile phone. With a couple of taps, you can buy and sell stocks from all over the world. Property purchase however has a range of hurdles to pass before a sale can go through. There is surveying, legal work, financing, and we haven’t even discussed a collapsed chain yet… All in all, traditional property purchase can be an arduous task to undertake.

The final case for investing in stocks and shares is liquidity. Shares typically have high liquidity, especially those within the FTSE 100. This suggests that people trade them frequently, meaning that there is normally a buyer for every seller and transactions are nearly instant. This is not always the case with property. When it comes to selling real estate, there can often be a long, protracted process in finding a buyer and completing the transaction.

So, we’ve established that investing in stocks takes less capital, can be done more easily and can be done quickly. If that’s the case, what’s the argument for investing in property? Simple, return on investment, or in other words, profit.

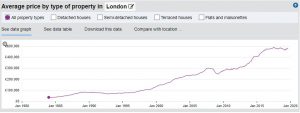

returns on London property

ROI is one of the most important things an investor looks for in any deal. And in property vs shares, there is only one winner.

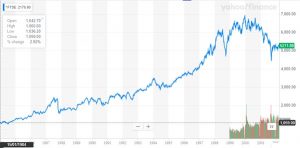

Let’s look at a comparison of the value of the FTSE 100 and in an averagely priced London property over a 10-year period.

At the end of September 2009, the FTSE stood at 4988. At the same time, the average house price in London stood at £267,501. If we fast forward 10 years, at the end of September 2019, the FTSE stood at 7247 and the average London house was £474,601.

FTSE ROI = 45.2%

Property ROI = 77.4%

To make the example stand out even further, let’s take the comparison back to when the FTSE started back in 1984. In January, when the index started, it stood at the base level of 1000. The average London home was £31,561. As we saw before, at the end of Sept ’19, the FTSE stood at 7247 and the average London house price was £474,601.

FTSE ROI = 584.3%

Property ROI = 1403.7%

Earlier in the piece we identified that capital, ease and speed were some of the hurdles preventing investors from entering the property market. What if I told you there was a way to step around them?

A bridging loan is a form of short-term financing that can provide between £50,000 and £10,000,000 in a matter of days. The terms are flexible to suit you needs and an offer in principal can be agreed within hours of the initial enquiry. In addition to this, poor credit, CCJs and arrears will be considered, and no personal guarantees are required. Loans can be on 1 to 24 months, but if you want to end the loan early, there are no early repayment charges or exit fees.

If you would like to learn more about bridging loans, simply call our dedicated team on 0203 051 2331 or use our contact form to get a call back.