bridging finance demand increased in Q1

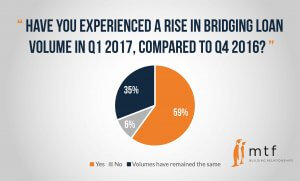

Demand for bridging finance soared in the first quarter of 2017, with 59% of brokers experiencing a rise in bridging loan volume, up from 31% in the fourth quarter, according to the latest Broker Sentiment Survey conducted by mtf.

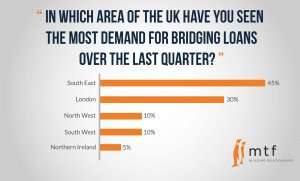

The South East saw the biggest demand for bridging loans in the UK at 40%, up from 29% in Q4 2016. The second highest area of demand was London, at 30%.

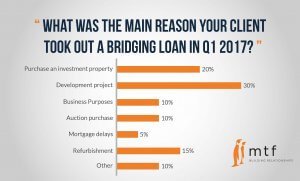

The most popular reason for taking out a bridging loan in the first quarter was to fund a development project at 30%, followed by the purchase of an investment property, at 20%. Demand for financing investment purchases grew from 6% in the fourth quarter, showing healthy appetite from landlords to take on new properties, despite recent changes to tax relief.

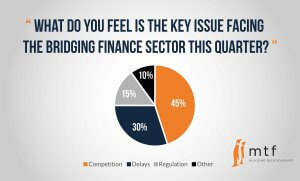

Some 45% of the 100 brokers surveyed said competition was the key issue currently facing the bridging finance sector, while 30% cited delays, followed by regulation at 15%.

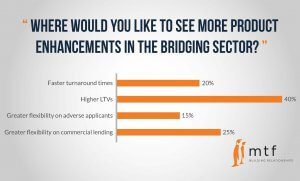

When asked ‘where would you like to see more product enhancements in the bridging finance sector?’ The majority (40%) of the brokers surveyed said they would like to see higher Loan-To-Values. Some 25% wanted greater flexibility from lenders on commercial lending and 15% wanted greater flexibility on adverse applicants.

When it comes to choosing a bridging finance lender for their clients, 40% of brokers said interest rates and pricing was most important, while 30% said speed of completion was paramount.

The feedback from brokers points to a strong need for specialist lending, particularly from developers who continue to support the housing market by providing further supply to meet the ever-constant demand. Bridging finance is increasingly being used as a viable financial tool to provide real time funding to plug any gap before longer term finance can be put in place.